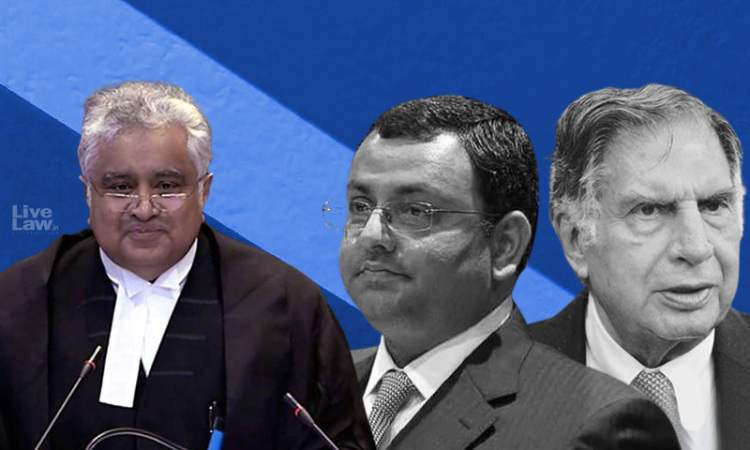

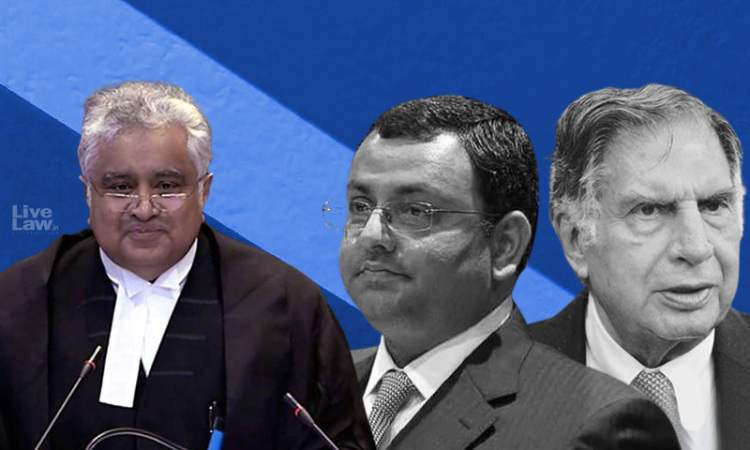

Tata Sons v Cyrus Mistry : NCLAT Has No Power To Appoint Chairman, Submits Salve

Mehal Jain

8 Dec 2020 9:00 PM IST

The court-room exchange of the first day of arguments in Tata Sons v Cyrus Mistry case in Supreme Court.

Next Story

8 Dec 2020 9:00 PM IST